The latest BofA managers’ survey shows a slight improvement in portfolio liquidity, strong rotation of commodities and a loss of confidence with China’s growth.

Investor sentiment among professional managers remains bearish, although not touching the extreme depression. According to the latter Investment Manager Survey published monthly by BofA, 60% of investors surveyed predict a weaker economy in the next 12 months. Because of that, the consensus estimate (68% and counting) is for a mild recessionglobal economic soft landing that will begin on last quarter of 2023 or early 2024. Moreover, while still in the minority, the percentage of managers who do not even see an economic recession in the next 18 months is increasing.

With these more resilient economic forecasts first rate cut postponed from the Fed The consensus is still on the first half of 2024, but is now leaning towards the second quarter versus the first quarter. It also affects the company’s earnings prospects. Managers’ pessimism about business results is at its lowest since February 2022.

At the portfolio level, average liquidity has increased in the July survey, but only slightly. From 5.1% last month to 5.3%. This is still a relatively high cash level, but far from the highs touched at the peak of the scare in October 2022 when it hit 6.3%.

Position is still cautious

However, in a broad sense sentiment among managers still ‘very low’, as defined by BofA. This is a reflection based on treasury positions, income allocations and economic forecasts.

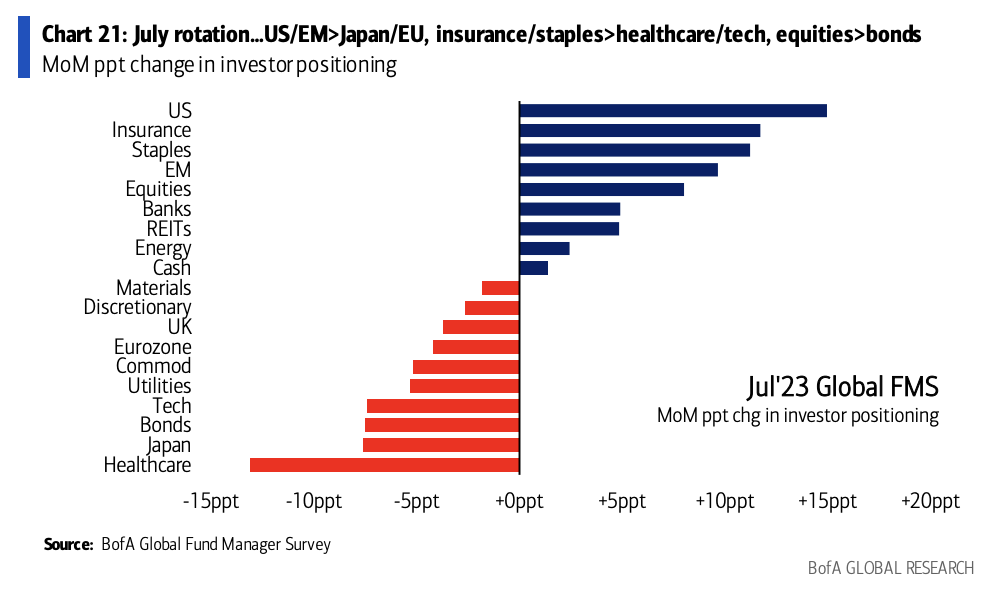

And we see this reflected in the still cautious positioning of the portfolio. Compared to the last 20 years, investors are long-term bonds, consumer staples, euro and underweight cash and equities, dollars, reits, energy and technology. In absolute terms, as we can see from the chart, managers are positive on cash, EM, healthcare, alternatives, and commodities, while undervalued equities, UK, utilities, real estate, and US.

As for the most recent changes, in July, managers in July rotated across US assets, insurance, commodities, emerging markets, equities, and beyond healthcare, Japan, bonds, and technology.

Commodity Capitulation and Disillusionment with China

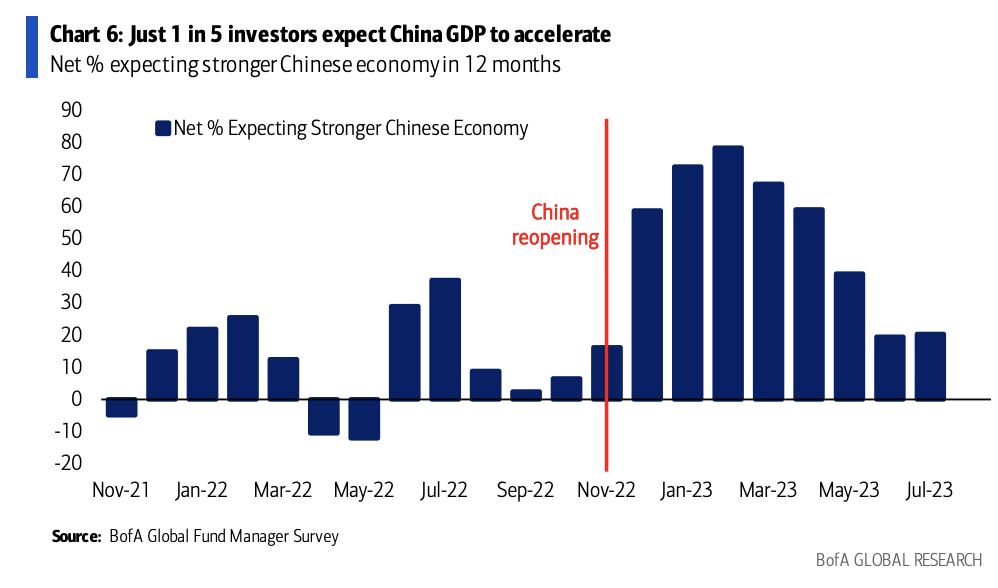

Very interesting to see how sentiment has changed with china, one of the managers’ big bets for the year. In February, four out of five predicted that China’s economic growth would accelerate rapidly. Now almost one in five expect it. Thus, China’s GDP forecast for Investment Manager Survey it was at its lowest level in six months, at 4.6%.

Another important movement this month is the capitulation that occurred in raw material. Managers have not disparaged this asset class since May 2020. This is the fastest three-month turnover since May 2013.

“Entrepreneur. Internet fanatic. Certified zombie scholar. Friendly troublemaker. Bacon expert.”