According to the CEO of the Cardano Foundation, privacy is not a big issue with CBDCs, and we should all be a bit more ambitious when we consider its potential.

Central bank digital currency (CBDC) has become a new hot topic in crypto, banking and FinTech in recent years. However, they are not without controversy, particularly among the crypto community.

Beginning, cryptocurrency was developed as a decentralized alternative to eliminate middlemen, increase transparency and promote accountability.

Unsurprisingly, many people fear that governments will adopt similar technologies, which could increase oversight and centralize financial power.

BeInCrypto talks to Frederik GregaardCEO of the Cardano Foundation, the day after his appearance the previous Wednesday Parliamentary Group of All Parties on Crypto and Digital Assets, where he was invited to discuss CBDC. The group, which is a voluntary association of MPs, examines the work of the UK government and regulators.

bold agenda

However, the main focus will be the upcoming CBDC British, or “digital pound”. This project is also known as “Britcoin”. The UK government has not yet committed to its implementation. gregard he wanted to emphasize that current discussions on CBDCs need to be broader and more ambitious.

“Yeah, I teased them dramatically and said it wasn’t a tech issue,” he told BeInCrypto. “It is a question of what England wants.”

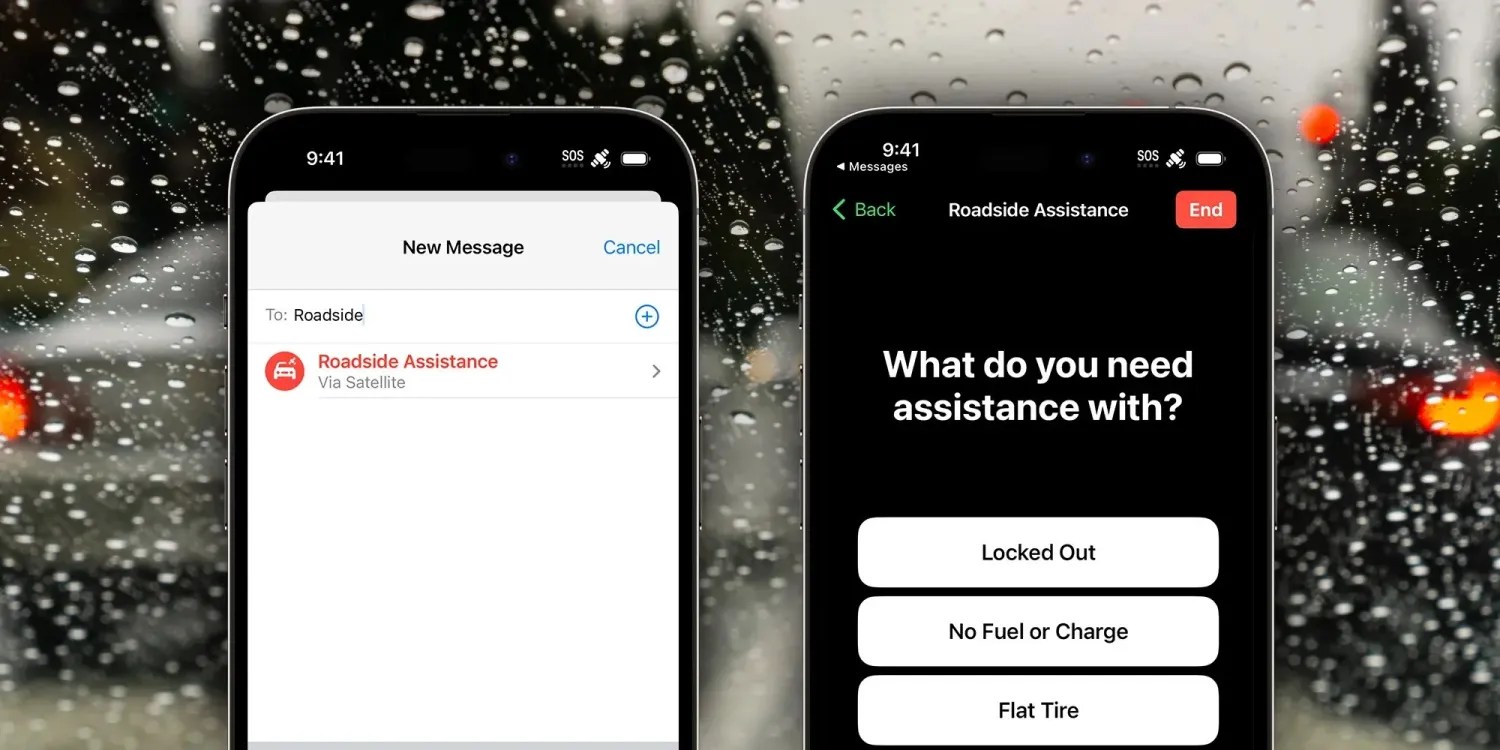

On the official website of the Bank of England, the benefits of the digital pound are apparent almost indistinguishable of those that offer mobile banking and contactless payments. The UK is already one of the world leaders in digital payments.

Cash is rarely used, and technology is contactless it has been the norm in retail transactions since at least the mid-2010s. Barclays changes capacities contactless the default option for new debit cards in the UK in 2014. HSBC, Natwest and Lloyds Bank They did the same in 2015.

“The pound is already digital, so I don’t understand the discussion,” he said. “I’ve been here 24 hours and I’m only on my phone. I haven’t taken out the credit card yet. I’ve never withdrawn any cash. So you’ve had enough of digital, you know?

“To be honest, I think it’s basically a waste of time to go down that rabbit hole.”

Privacy is not an issue with CBDC

“I think CBDC has a different scope than what you’re talking about now with respect to privacy. Privacy is not the problem. We can easily solve it cryptographically. The real issue here is, can you build something that’s actually adopted? And not just because of the population here, but because of all the peers you have around the world?

Inside it consulting document, posted month ago “support trust” The UK government said the digital pound would be subject to “strict privacy and data protection standards.” The digital pound will be “at least as private as the current form of digital money.”

Payment interface providers will verify users but anonymize personal data before sharing it with central banks. Governments and central banks will have no access to the user’s personal data, except for law enforcement agencies, in limited circumstances, such as digital payments and other bank accounts.

Think big

“Let’s be clear about what we’re comparing,” said Gregaard. “Look at the data that is being collected now on our smartphones. And when we used our debit card, and when our telecommunications provider and all the CCTV cameras monitored us…”

Gregaard pointed around with a concerned look, referring to the fact that London was one of the cities most guarded on the planet. “Me as a Swiss, you know… it’s very, very strange to me. So I think what we need to talk about is what are we comparing. Good?”

“I think something extraordinary can be done in blockchains, which is geared more toward cash for the carrier or carrier assets, and to maintain privacy. Or at least give you, as a user, the ability to control your privacy, which you don’t have right now. And that’s where I’m coming from when I say that privacy is not an issue. We can design it in such a way that you can have lots of data points itself.”

Throughout the conversation, Gregaard emphasizes the importance of thinking big, especially in a regulatory sense. While acknowledging the macroeconomic turmoil from Brexit, Gregaard believes it has advantages. “Discussion [de la UE] in Brussels they are very colorful. It’s very difficult to satisfy in many directions.”

The UK should not follow the EU or US

“[El Reino Unido] it has been the center of capital markets for a very long time. You have a real opportunity to design something that really puts you in the landscape and then creates jobs and growth. So, why not take it? asked Gregor.

Last month, BeInCrypto revealed that the UK is actively choosing not to take the lead in regulating cryptocurrencies. According to Gregaard, this strategy is wrong.

“If you sit and wait in jurisdictions that are not very clear and very successful at what they do, that’s bad. So if right now you’re really taking inspiration from the European Union and the United States, I think your data points are wrong. Where your data points should be is more towards Singapore or Switzerland,” said Gregaard.

“The United States and the European Union are huge markets. They may be able to change the whole agenda. But that’s not what they’re doing now.”

Disclaimer

All the information contained on our website is published in good faith and for general information purpose only. Any action taken by readers upon the information found on our website is strictly at their own risk.

“Entrepreneur. Internet fanatic. Certified zombie scholar. Friendly troublemaker. Bacon expert.”