The role of technology in accelerating UK tax filing has become increasingly important in recent years. As the digital age continues to evolve, the UK government has been proactive in leveraging technology to simplify the tax filing process, making it more efficient and taxpayer friendly. This transition to digitization benefits not only taxpayers, but also the government, as it reduces administrative costs and increases the accuracy of tax collection.

The UK government introduced the Making Tax Returns Digital (MTD) initiative in 2019, a transformative program with the aim of modernizing the UK tax system. The MTD initiative requires companies to maintain digital records and use software to file their VAT returns. This digital shift makes it easier for companies to keep track of their tax affairs, reducing the risk of mistakes that can result in fines.

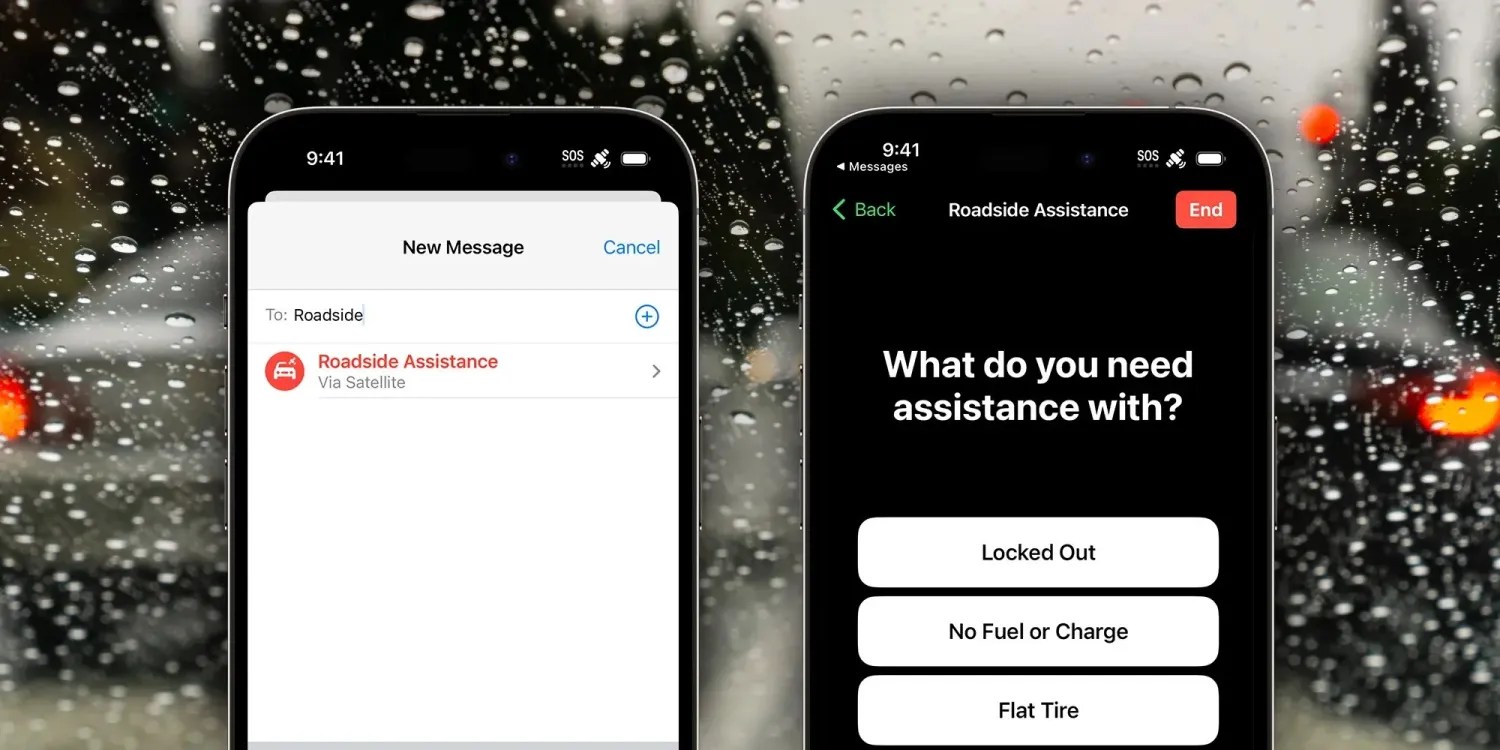

In addition, the use of technology in tax reporting also allows taxpayers to report their taxes anytime and anywhere. With the advent of mobile apps and online platforms, taxpayers can now file their taxes conveniently, eliminating the need for physical paperwork and visits to tax offices. This significantly reduces the time and effort required to file taxes, making the process less daunting for taxpayers.

Artificial Intelligence (AI) and Machine Learning (ML) are also playing an important role in streamlining the UK tax filing process. This technology is used to automate routine tasks, such as data entry and calculation of tax obligations, thereby reducing the possibility of human error. In addition, AI and AA can analyze large amounts of data to detect anomalies and potential fraud, thereby increasing the efficiency and integrity of the taxation system.

Apart from facilitating the tax reporting process, technology also facilitates better communication between taxpayers and tax authorities. The digital platform provides a channel for taxpayers to ask questions, seek advice and receive updates on their tax matters. This has increased the transparency of the taxation system and increased the trust of taxpayers.

However, the transition to digitalization is not without challenges. Cybersecurity is a major concern, as digitizing tax returns involves handling sensitive personal and financial information. The UK government has realized this and has implemented strict security measures to protect taxpayer data. Regular audits and updates are carried out to ensure the security of the digital platform.

Apart from that, there is also the issue of digital exclusion. Not everyone has access to the technology or digital literacy required to use online tax reporting systems. To address this issue, the UK government has provided support in the form of a digital help desk and waivers for those unable to use digital tools.

In conclusion, the role of technology in accelerating UK tax filing is undeniable. Digitizing the tax system has brought many benefits, such as greater efficiency, reduced errors, and a better experience for taxpayers. However, it is critical that these technological advancements are implemented in a way that ensures the security of taxpayer data and the inclusion of all taxpayers. As technology continues to evolve, it will no doubt play a more significant role in the future of UK tax filings.

“Entrepreneur. Internet fanatic. Certified zombie scholar. Friendly troublemaker. Bacon expert.”