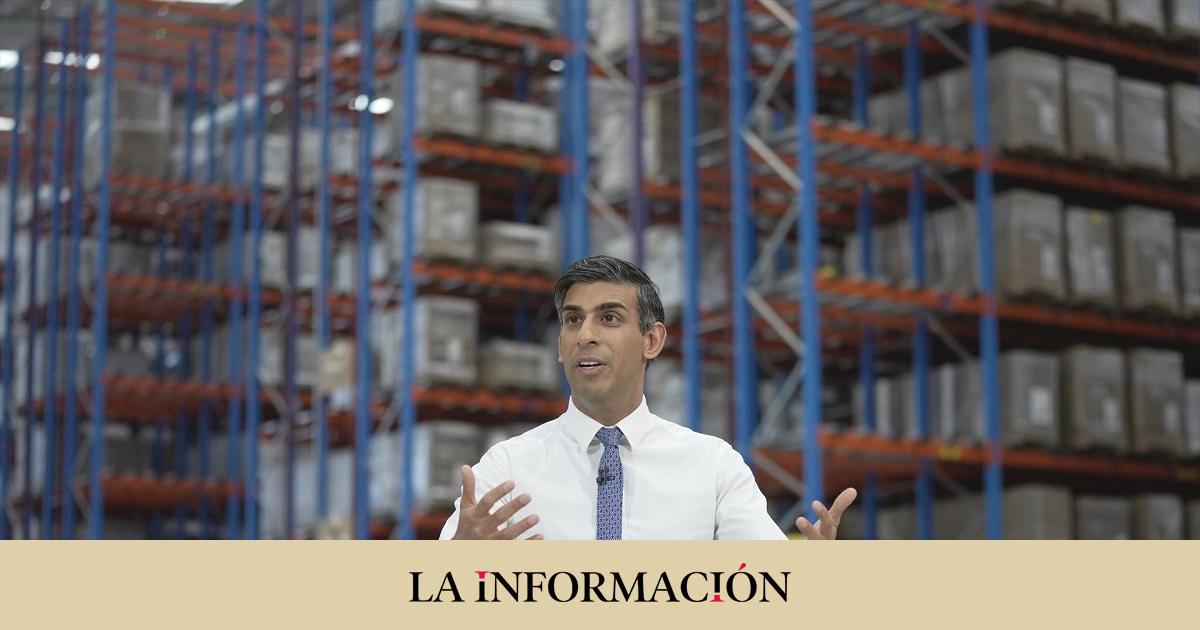

British Prime Minister Rishi Sunak said on Sunday that his government had “a plan that will work” to deal with high inflation in the UK -located at 8.7%- and emphasized “total support” for the Bank of England as it has raised interest rates to 5%.

In an interview with BBCTory leaders were asked today about the latest move approved by the British issuing bank’s monetary policy committee, which was announced last Thursday half point interest rate increase at the highest level since 2008.

“I think the record of the Bank of England, including the Governor (Andrew Bailey), over a long period of time, is that Inflation can be managed properly and residents must have confidence that it will come down to the target (2%),” he said.

Full support for the Bank of England

Sunak reiterated that bank entities have “full support” and said that there is “no alternative to lowering inflation”, which lies at a “historically high level”, according to the Office for National Statistics (ONS). The Chief Executive acknowledged that the decision to raise interest rates was “difficult” and “not very popular” although maintaining that “it is the right thing for the country in the long term.”

“I never said that it wouldn’t be difficultbut I want to give assurances to citizens that we have a plan, the plan will work and we will overcome it,” Sunak said, reiterating that “interest rates are a consequence of high inflation.” In this sense, The conservative leader also stressed that ” it should be very clear that what hurts citizens, what causes challenges in their daily lives and in their budgets, is inflation.”

Follow the latest economic indicators, various analysts estimates that tariffs will reach 6% in early 2024 -meaning its maximum peak in two decades-, which in turn sparked concerns about the consequences of rising mortgage costs in the country. The Institute for Fiscal Studies in the United Kingdom (IFS), an influential think tank in the country, has warned that rising interest rates could lead to around 1.4 million Britons with mortgages losing 20% of available economic capacity.

“Entrepreneur. Internet fanatic. Certified zombie scholar. Friendly troublemaker. Bacon expert.”

:quality(85)/cloudfront-us-east-1.images.arcpublishing.com/infobae/AMRMWFE47ZGLRAZ2KNWCYXWBW4.jpg)