This will be particularly important for industry in Agder, Rogaland and Hordaland, but also in the Northwest, in Kongsberg and in Oslo. Actually all of Norway. In 2019, the supplier industry had a turnover of NOK 397 trillion, and was thus our second largest industry.

The major investment in offshore wind must, like the supplier industry, have profitability such as ml. Floating offshore wind is a technology under development with a currently limited market, and will need state support in a start-up phase. But bottom-fixed offshore wind is all profitable, provided that production and distribution play a role in the offshore wind investment we now see in our North Sea livestock, such as Denmark, the United Kingdom and the Netherlands.

Incredibly large investments are now being styled into green investments throughout the world. The driving forces are the same as in all business activities, that the investments at least over time become profitable. Without a perspective on profitability, the investment model will dry up.

The offshore wind farms here can finance themselves and even give Norway large revenues

Most people understand that no one wants to run a smelter at a loss, build ships that do not make a profit, set up an engineering company based on a permanent deficit or invest in a battery factory without the prospect of a profitable sale. Most people will probably also understand that producing, distributing and storing renewable energy, which is so essential in the green shift, must be profitable over time. Also when produced in offshore wind farms in the North Sea.

The authorities have a central role in the initiative through support schemes for tech development, regulatory measures, public / private cooperation, incentive schemes and tightening. Enova support, electricity certificates and CO2 pricing – to take a few examples. In other countries, government price guarantees are used as a driving force until the business is profitable.

Principles of whether profitable business must be continued in the green shift. It should also be the basis for which solutions the authorities choose for the development of offshore wind in the Southern North Sea II. Financing the power supply to Norway from the Southern North Sea II from the state budget, as some suggest, is quite meaningless when the offshore wind farms here can finance themselves and even give Norway large revenues.

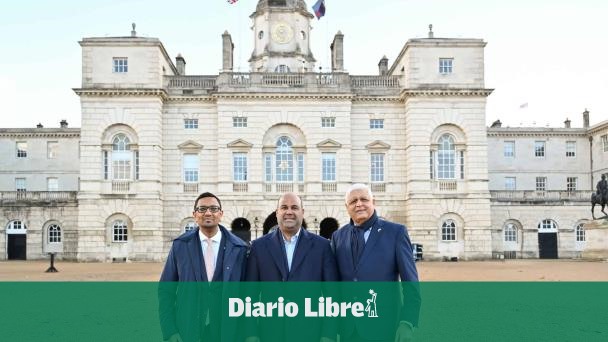

Steffen Syvertsen

CEO of Agder Energi

Tom Fidjeland

Director Admin i GCE NODE

“Entrepreneur. Internet fanatic. Certified zombie scholar. Friendly troublemaker. Bacon expert.”